How to Open a Company in The US

You know it, I know it, everyone knows it: The USA is one of the most lucrative markets in the world.

Its legal system is transparent, the infrastructure is excellent, and it’s filled with consumers ready to buy whatever you want to sell. Even with COVID-19 killing markets across the world, the US GDP is still growing rapidly. Long story short: if you want to start your business or eCommerce storefront, the US market should be on your radar.

If you’re ready to start planning your brand-new US storefront, there’s good news: the United States is relatively accessible! It is possible for non-residents to register certain business types, and through the magic of dropshipping, your operations can benefit from different states’ locations and tax laws.

Still, there’s some work to do if you want to avoid legal hot water. Registering your business with the government, selecting the right company designation, and choosing the right locale are all important steps for financial success in the United States.

Why register a company in the USA?

Enrolling your business is not really required, but there are advantages. Registering can help lower your tax rate and qualify you for deductions, explain your reporting requirements, and (most importantly) identify who’s responsible for your business.

There are unincorporated and incorporated business types in the US, and which you choose largely depends on your business's performance, scope, and objectives.

What is an incorporated business?

Incorporated businesses are companies where the legal requirements for the business are separated from their owners. Companies in the United States have to deal with a lot of lawsuits, so registering can save you a lot of headaches as you scale up. Registering is also good for avoiding responsibility for your business's debt or legal standing. Incorporated companies also get tax breaks, meaning they will usually pay less in taxes than an unincorporated business.

The downside of registering boils down to the administrative workload involved. You need to remember to file your taxes annually (not a small task!) and adhere to requirements like having a physical address in the country. If you have a US-based address, THEN you will have to know your address's local and state business laws and, of course, taxes.

What is an unincorporated business?

Unincorporated businesses, such as sole proprietorships and partnerships, are not registered, meaning their owners are legally the same as their businesses. Many entrepreneurs choose this option because it's cheaper to start and operate, at least in the beginning. It also lets you operate privately, as unregistered companies are not obligated to file as much paperwork with the government.

Sounds good right? Well, the disadvantages for unregistered businesses can be unforgiving, especially if you decide to scale. Because you and your company “count” as the same legal entity, litigation against the company can affect you directly. Unincorporated businesses also pay higher tax rates because they can’t take advantage of corporate tax breaks.

Basically, look at unincorporated businesses as short-term setups. If you start to scale or grow, get incorporated. While the initial cost of registering a company can be daunting, the savings and legality that registration affords are often worth it.

What kind of business should I open in the US?

So you’ve decided to register your business in the USA. Congrats! The next step is to pick a business configuration. This is going to depend on the nature of your business and the scope of your operations. Types of business configurations generally include Sole Proprietorship (SP), General Partnership (GP), Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Corporations.

| Business Types | Description | Best for |

|---|---|---|

| Sole Prop |

• No demarcation between company and owner • Owner subject to income tax • Low cost to set up and operate | Entrepreneurs who want to start quickly and have small-scale operations |

| General Partner |

• Similar to sole proprietorship except co-owned • Both partners subject to income tax • Low cost to set up and operate | Partner entrepreneurs who want to start quickly and have small-scale operations |

| Limited Partner |

• Similar to GP, but one owner bears sole responsibility • General partner oversees enterprise, pays income tax • Low cost to set up and operate | Small-scale startups who want to start quickly and rely heavily on investments |

| LLP |

• Partners co-own, operate the business • Liability tied to initial investment of active partners • Heavily affected by local regulations | Co-founded enterprises that want some form of litigation and financial protection |

| LLC |

• Owners and business are legally distinct entities • Personal assets are shielded from business liabilities • Multiple potential tax benefits • Easier to register than a full corporation | Entrepreneurs who want to eventually legal protections or want to scale operations |

| C Corp |

• Multiple investors, shareholders involved • Ownership is legally distinct from business assets • Numerous requirements, including board of directors • Must hold annual meetings with multiple executives | Entrepreneurs who are ready to scale, qualify for tax benefits, have multiple investors or shareholders |

LLCs vs C Corps

There is no ‘correct’ answer for what kind of entity structure you should start as an eCommerce business in the USA. Each formation has advantages and disadvantages, so make sure to weigh and balance what your company needs before deciding on a structure. That said, the two most common structures for online businesses are LLCs and C Corporations.

LLC formation is simpler than a C Corp as you only need to file your articles of organization and create an operating agreement. For taxes, LLC owners can decide if they want to be taxed as a flow-through (pass-through) entity which allows them to report taxes on their personal tax return, or as a C Corporation which entails corporate taxes. Ownership is flexible, allowing for both sole or multi-member ownership and division of investment, responsibilities, and more. Finally, LLCs do not require regular shareholder or board of director meetings.

One major downside of LLCs in comparison to C Corps is the ability to raise capital. LLCs require sometimes complex private arrangements between the company and investors, which C Corps can simply handle by selling shares of the company.

"Depending on your industry—like cannabis, hospitality, or remote services—you may also need tools to manage payroll, tax compliance, or employee onboarding efficiently. Platforms like Hybrid Payroll can support these back-office functions as you grow.."

In fact, if your business is already established and looking to increase online presence, then a C Corp may be superior to an LLC, but note that it comes with additional responsibility, paperwork, and tax requirements.

C Corp formation requires not only articles of incorporation, but a long list of post-filing steps. They have to adopt corporate bylaws, issue stock, hold shareholder meetings, elect a board of directors, submit an IRS 83(b) form, and this administrative work continues even after incorporation. C Corps face the potential of double taxation where the business pays net income tax while the shareholders pay income tax on their dividends. It’s not all bad for this type of formation though. Ownership is based on shares of stock, which makes it much easier to raise venture capital, though shareholder meetings are a legal requirement.

Generally speaking, C Corps have a much higher capital generation potential than LLCs, but you should have a team of professionals employed to tackle the administrative and legal work. If you're a smaller business and trying to get started in the USA, an LLC is likely the simpler and safer approach.

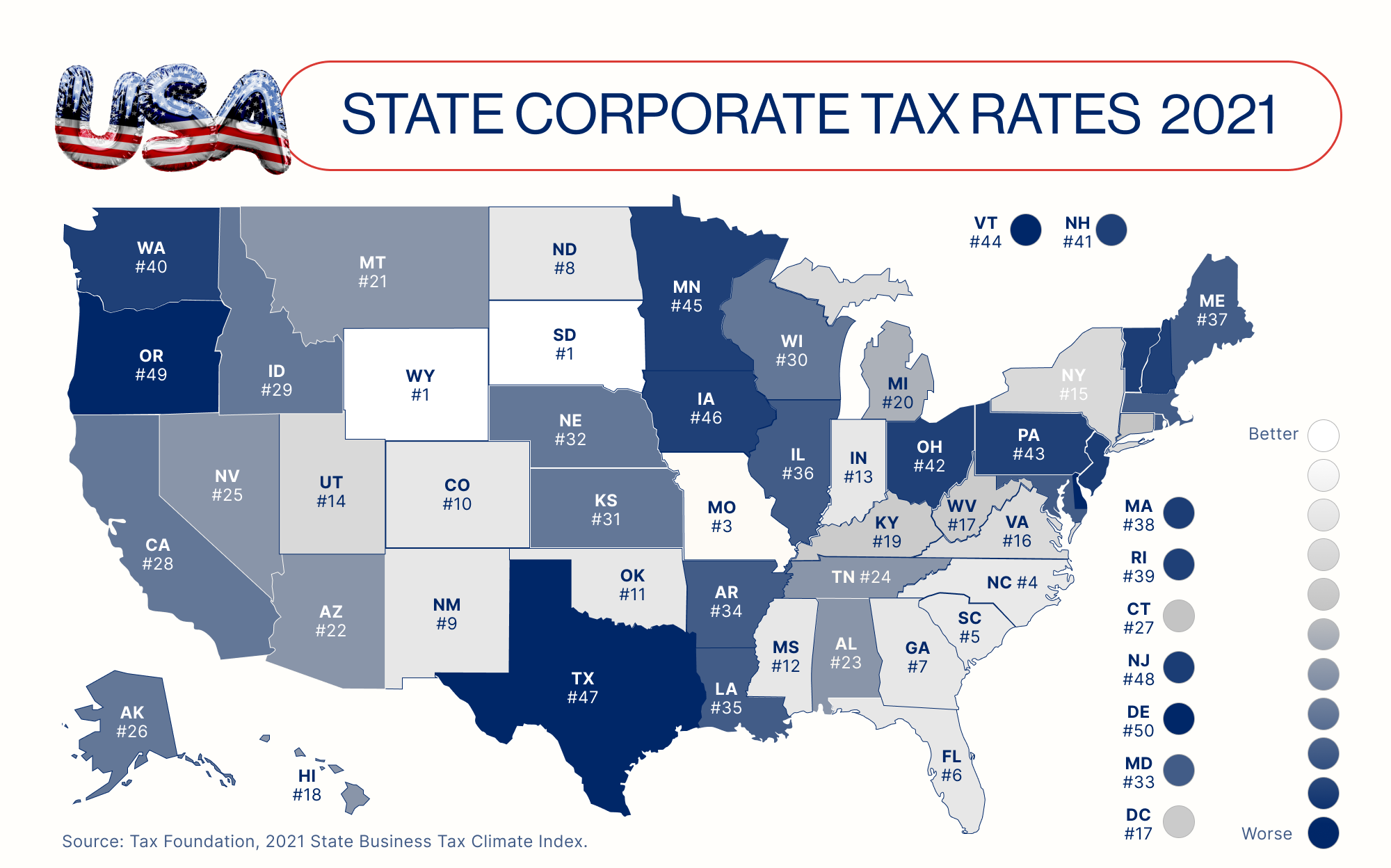

Where Is It Best to Open a Company in The US?

The United States has 50 states, and each one has a unique approach to governing businesses. But because you’re opening a business, you have the advantage of picking a state that fits your business! Delaware stands out as a popular tax shelter for businesses as the state does not require corporate tax if a registered corporation does not operate from inside the state. Still, there are other states that warrant consideration due to friendly tax laws like Florida, lack of income tax laws like Wyoming, sheer size of economy and workforce availability like California or other attractive measures that are making states like Nevada and Maryland attractive for business.

California LLC Taxes and Filing Fees

California has a massive economy. If the state was a country, it would have the fifth-largest GDP in the world, sitting just behind Germany and in front of India. If you want to have any localized business operations, registering in California gives you access to this economy, but the state is also infamous for having high business taxes, multiple fees, and paperwork. These laws change with some frequency, so check California’s LLC and corporation framework before filing.

California LLCs have an annual franchise tax of $800 before 2024, though this fee is waived for the first year. LLCs must also pay city or county taxes, employer taxes, and taxes related to the industry. They will also pay income taxes between $900 and $11,790 depending on how much the company earns, starting at a minimum of $250,000. LLCs in California are taxed as “pass-through” entities, meaning the LLC pays no corporate income tax, but revenue is passed to LLC members to pay as personal income tax.

California C-Corporations pay an annual tax rate of 8.84% and at least $800 annually for franchise taxes, though the franchise tax is currently waived during the first year of operation. LLCs can also be taxed as C-Corporations in California.

Finding a name for your company in California is free. Filing fees for LLCs in California include a $70 payment for organization article filing and a $20 fee for statement of information filings (Form LLC-12) with the California Secretary of State. There are additional fees depending on the municipality. There is a 7.25% sales tax in California.

Delaware LLC Taxes and Filing Fees

Delaware is a popular spot for new businesses opening in the USA because the state is considered a tax haven with a high degree of privacy. Businesses do not have to disclose who their executive staff are (though they do have to mention the name of the incorporator or agent.) Companies not operating in Delaware can avoid corporate income tax and pay a much cheaper franchise tax, and the state itself has business-friendly interest-collection laws. There is also no state sales tax, making it attractive for consumers as well.

Delaware LLCs, LPs, and GPs pay an annual franchise tax of $300, but no annual report is required. Taxes for the prior year are paid before June 1, with failure to pay resulting in a penalty of $200 and a 1.5% interest rate per month on both taxes and the penalty.

Delaware Corporations are subject to the same penalties and tax schedule but pay a minimum of $175 for franchise taxes. Additional taxes can range between $400 and $250,000 depending on certain state qualifiers. Corporations must file an annual report with fees ranging from $25 and $50 for domestic companies and $125 for foreign companies.

Filing fees in Delaware vary but generally lay between $50 and $200, with some outliers as high as $2600 and as low as $5. The state offers its Delaware fee schedule that you should keep on hand as you explore the process. Another benefit of filing in Delaware is their comprehensive entity name reservation tool, which is online and available for anyone to use. Be sure to check what names are available as you’re going through the process of setting up your company.

Florida LLC Taxes and Filing Fees

Florida is another state that has tax-friendly laws, meaning most businesses in the state are exempt from income tax. Instead, company owners and partners pay income tax on their earnings. Corporations still pay corporate tax rates.

Florida LLCs are pass-through entities and do not pay state income tax if filed as a partnership or disregarded entity. If they are filed as a corporation (rare in Florida), they are subject to between 3.3% and 5.5% income tax.

Florida Corporations still pay lower income taxes than most other states. The standard fee is 5.5%, but exemptions are often available to lower this rate to a minimum of 3.3%. The first $50,000 in income is exempt from this tax rate.

Filing fees for LLCs in the state range, with annual reports filings coming in between $139 and $539, LLC registration starting at $100, and several other fees often required. There are separate fees for Florida corporations for filing, annual reports, and additional services, though Florida’s entity name search tool is free to use for the public.

Nevada LLC Taxes and Filing Fees

Nevada provides assistance to new businesses through the state government but that’s not all. Registering a business in Nevada is relatively straightforward and inexpensive, and the state provides privacy for LLCs because it does not formally require them to share information with the IRS. If anonymity is your goal, Nevada should be high on your list.

Nevada LLC and other business applications are available online and in several different formats depending on your company’s needs. Instead of an individual income tax or corporate income tax, Nevada utilizes a gross receipts tax (turnover tax) that is favorable for businesses with high profit margins or organizations that have vertical integration. The state levies a 6.85% sales tax for the state and as little as 1.53% for local sales for an average of 8.23% overall.

The filing fees for LLCs in Nevada are around $425 in most cases. This cost includes the articles of organization, the initial list of managers, and the state business license charges. The articles of organization processing fee, which is included in the $425 cost at $75, can be expedited for between $25 and $1,000 to lower the wait time to 24 hours or 1 hour, respectively. Nevada’s registered agent cost is free unless the agent is not an employee or owner of the company, and name reservation comes with a $25 fee, though searching for an available name is free.

Maryland LLC Taxes and Filing Fees

Maryland has incentives for entrepreneurship and innovation, but unlike others on this list, Maryland LLCs can enjoy much of the same protection that corporations receive, meaning LLCs don’t have to take on additional responsibility to qualify for powerful tax deductions and permissions. This fact alone makes Maryland a great place to consider if you want to spend a longer time as a small business before registering as a corporation.

LLCs and corporations in Maryland have a convenient portal to approach the process of registering and filing for taxes as pass-through entities as well as an entity name search tool that is free to use. There are no gross receipts taxes on manufacturers, corporate franchise taxes, unitary profit taxes, income tax on foreign dividends, or intangible property taxes (great for online-only businesses).

LLC members are responsible for their personal income tax returns only and pay on a graduated fee table that peaks at 5.75% on income over $300,000 or $250,000 for single filers. Corporations pay Maryland income tax at a rate of 8.25% of net income.

Registering an LLC in Maryland entails fees between $50 and $100 but will generally cost a new entrepreneur around $200 for organization and registration. Filing for a corporation varies in the state, but incorporation starts at $100 with further fees applying on the Maryland Fee Schedule.

Wyoming LLC Taxes and Filing Fees

Wyoming has many benefits for new companies, especially because the state has no income tax. Filing for an LLC or corporation is relatively inexpensive compared to other states, and their reporting fees are also low. The state is also good for companies wishing to maintain some form of privacy as Wyoming supports charging order protection laws, protecting the business from litigation against individual owners.

Wyoming LLCs qualify as pass-through entities, with LLC members only obligated to pay a self-employment tax of 15.3%. There is no personal or corporate income tax, no gross receipts tax, no franchise tax, and no excise tax. Wyoming Corporations are subject to the same tax laws, though they will be responsible for a 21% federal income tax. There is a 2% to 4% sales tax in Wyoming.

Filing fees for a Wyoming LLC range from $60 to $350, but most first-time companies will likely pay around $250 for organization and certification. Corporations would pay the same, though some additional fees may be required. Trademark registration in the state starts at $100, with renewals costing $50, though finding a unique entity name is free. Additional fees for all actions can apply, and having the Wyoming State Fee Schedule is recommended.

How to Name Your Business

There is no other way to put it: naming your company is going to be the hardest decision you’ll have to make.

Your company’s name is probably going to be the first thing a new customer will see. A good company name needs to reflect what you represent — your identity, goals, mission, and outlook. It needs to show what your company offers and your position in your industry. On top of that, you need to check with your local government or business bureau to make sure you’re avoiding naming restrictions. The easiest way to do this is to use an entity name search tool.

A name has to be catchy, memorable, and not give the wrong impression. Amazon's original name was Cadabra, but they changed it to Amazon (to insinuate they have everything from A to Z) after the original name was mistaken for "cadaver." Even Google changed their name (thank goodness) from the original moniker, Backrub.

While you can change your name, you should try to nail it on the first attempt, as changing your name after registering requires additional administrative and legal work. It usually involves getting a new employer identification number (EIN), notifying the IRS, changing permits and licenses, and all of that is before you start paying for a rebranding.

Registering Your Business Name

There are three approaches to registering your business name to prevent others from using it. You can:

-

form a business entity like a C Corp of LLC.

-

register your business name as a DBA (doing business as) or a trade name.

-

register your business under a federal trademark.

It is possible to use all three approaches, but selecting one at a time is going to be the best fit for most people. In most cases, you’re going to register your company name as a legal entity. Each state will have its own laws for company name registration, so be sure to research your locale!

Trademarking is the option that will grant you the most protection because it applies on a national level. If another company on the other side of the country wants your name, too bad: it belongs to YOU. Any attempt qualifies as infringement and can result in a criminal conviction.

What is an EIN?

An Employer Identification Number is a unique ID for your company that the Internal Revenue Service (IRS) uses when figuring out how much the company owes in taxes. It’s a nine digit number which the IRS provides when you register your company as a unique entity. In many ways, an EIN is to businesses as a social security number (SSN) is to individuals.

While not all businesses are required to have an EIN, those that have employees, are incorporated, want to take advantage of certain tax benefits, operate as unique entities like LLCs, or wish to withhold taxes from income will need an EIN. All business structure types, non-profits, government agencies, estates, and trusts can apply for an EIN, and in almost all cases, must have one to conduct operations.

As a business owner, you can apply for an EIN through the IRS for free. Non-residents who are not in the United States but wish to do business there must apply by phone, though the IRS also accepts applications online, via fax, or through the mail for those inside the country. The IRS requires you provide:

-

the type of entity you're filing for.

-

the reason you are applying (these include forming a new business or changing your organization.)

-

the start date or date of acquisition.

-

the industry of your business.

EIN application turnaround time varies. Online, it’s immediate, though through other methods it can take between two to five weeks for fax or mail applications respectively.

Getting a Bank Account in The United States

Part of opening a business in the USA is opening an American bank account. Besides sole proprietorships and partnerships, having a bank account in the USA is usually a requirement of registering a business. You will want to opt for a business account, which necessitates the registration of an EIN so the IRS can find and tax members of your company. If you have stateside employees, operate as a corporation, file certain federal tax returns, or withhold taxes, you will need an EIN.

If you’re physically in the United States, you can visit a ‘high-street’ bank like the Bank of America or Chase Bank. There are also small and medium-size business banks like Bluevine or Grasshopper which are rated highly for online or eCommerce businesses. In most cases, you can apply for a business bank account with as little as a passport (or US driver's license) and your business’s EIN, though more documents like your articles of incorporations, business licenses, or DBA certificate may be required.

However, traditional banks are not the only option. Fintech payment service providers like Wise Business, Revolut, Remitly, Mercury, Payoneer, and even Paypal offer easy online solutions with support for multiple currencies and transfers across borders. These aspects make these solutions attractive to business owners who are already established outside the USA and looking to move in. Fintech services are usually faster than traditional banks, more convenient as they are primarily online and available on multiple devices, have 24/7 access and customer support, usually sport lower transaction fees, and don’t skimp on security.

Regardless of what you pick, having a bank account for your business is all but required. Consider what your business needs, and where they operate before deciding on a bank.

Conclusion

Opening a business in America can seem rough whether you are a resident or non-resident. The paperwork, fees, taxes, and regulations can be overwhelming, especially when the same rules do not apply everywhere. On top of this, you have to worry about startup costs, like buying inventory, managing shipping, hiring people to run your business, and designing your online storefront. While building a website is easier than ever before, it’s still another task to keep in mind while establishing your eCommerce business.

While this article serves as an introduction to starting your own eCommerce business, there is a lot more to cover and it can get confusing. If you have further questions, Hoory AI has been trained to answer questions about incorporating your business, so be sure to try it out if you’re serious about starting a business in the USA.

In the end, the USA still represents one of, if not the largest economy in the world. It is friendly to business in comparison to many other places, has huge buying power, and is home to the world’s largest privately owned companies.

Related posts

446,005 entrepreneurs like you already have a head start

Become one of them by getting world-class expertise delivered into your inbox, for free.